Pradhan Mantri Mudra Yojana (PMMY) Application Form PDF Download

Pradhan Mantri Mudra Yojana (PMMY) Application Form PDF Download for free using the direct download link given at the bottom of this article.

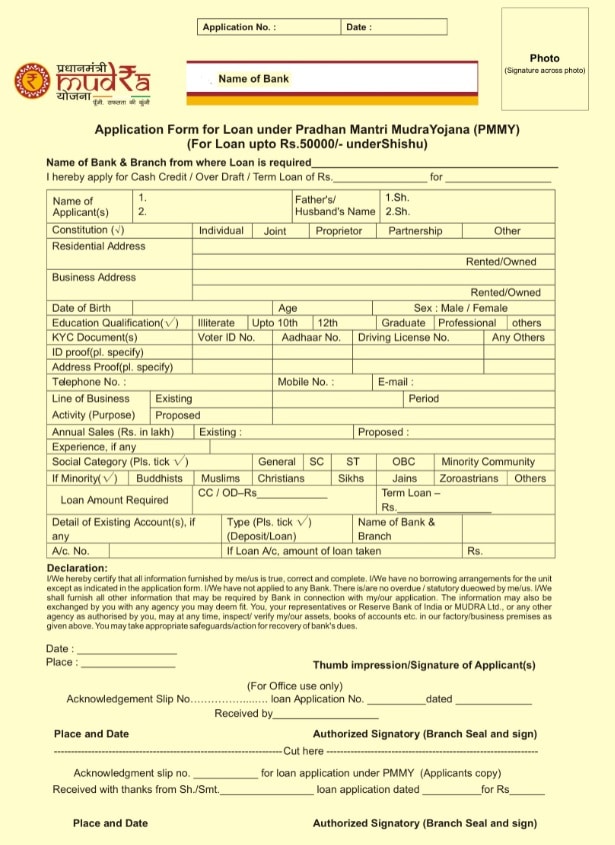

Pradhan Mantri Mudra Yojana (PMMY) Application Form

Here in this post, we are presenting Pradhan Mantri Mudra Yojana (PMMY) Application Form PDF. Prime Minister Mudra loan is given by the Government of India to the citizens of the country to open self-employment, for education, for doing agriculture, and to take advantage of other types of employment and service.

The main objective of the PM Mudra Loan Scheme is to provide loans to needy people at low-interest rates. So that a person can fulfill his needs. Under the Pradhan Mantri Mudra Yojana (PMMY), every person can get a loan of up to Rs 10 lakh. Three types of loans are available under the Pradhan Mantri Mudra Yojana. Which are given without any guarantee.

Pradhan Mantri Mudra Yojana (PMMY) Application Form PDF – Summary

Required information for official use:

- full name of the enterprise

- Application serial number

- branch Name

- Mudra Yojana Category: Shishu, Kishor, or Tarun

Business Information:

- full name of the enterprise

- Type of Enterprise: It can be either a Proprietary Partnership, a Private or a Public Limited Company, or other

- Proof of business address, complete with state and pin code related information

- Mention whether the business premises are self-owned or rented

- contact details

- Applicant’s email id

- Existing and proposed business activity

- Estimated start date of business in DD/MM/YYYY format

- Unit Registration Details

For a registered business, the following details are required:

- registration number

- Act under which it is registered

- Registered Office Address

- Caste certificate of the owners if they belong to SC or ST, OBC or any other minority community of their choice.

Background information of the owner/partners/directors

- Personal details like name, serial number, gender, date of birth, and other such details

- The contact information like your email id, contact number, registered residential address

- Highest educational qualification and professional degree

- Any valid proof of identity and address

- a copy of pan card

- Director Identification Number for all directors

- Total experience in the current line of business

- Relationship with other officers/directors, etc.

Details of associate entities and nature of their association

- Names of Affiliates

- Affiliates’ Addresses

- current bank account details

- Concerns about the nature of the association

- Limitation of Interest as an Owner or an Investor in a Partner, Director, or Associate Concern

Banking/Credit-related facilities availed (₹)

- Types of facilities for a savings bank account, current account, or even cash loan account or term loan or even letter of credit or bank guarantee

- current bank account details

- The total loan amount that has already been taken

- Total outstanding as of the date

- a security that has been promised

- Asset Classification Status

- Customer ID needs to be provided if you have a current account with the bank

- A certification statement that states that you have not applied for a loan with any other bank or financial institution

Total Credit Facilities offered

- Types of facilities in the form of cash or loan or term loan or even letter of credit or bank guarantee

- total loan amount

- provide the purpose of the loan

- Details of proposed primary security (with estimated value)

For Working Capital: Based on the applicable cash credit limit:

- Actual sales in the last two years

- Details of sales, revenue, inventory, working cycle, creditors and debtors, promoter’s contribution, total limit, etc.

For a term loan, the following details need to be provided:

- type of machine or equipment

- supplier name

- the total cost of the machine

- The contribution which is being made by the promoters in terms of (₹)

- Total loan amount required

- Repayment period with a given moratorium period

- Bank Details: This section requires the loan applicant to mention the details of the bank such as the name of the bank and the branch details in which one wishes to avail of the Mudra loan.

- Details of loan applicants: In the case of joint or multiple applicants, some personal information of the loan applicant or applicant is required to be filled in the form. This includes mentioning the name of the applicant/applicant, father or husband’s name of the applicant/applicant.

- Address Details: The applicant has to mention his residential address and details about it, whether rented or self-owned. In addition to residential addresses, similar information is required for business addresses.

- Educational Details: Applicants are required to mention the educational details also. If an applicant is illiterate, he can specify the same. Educational degrees such as 10th grade, bachelor’s, or professional degrees can also be submitted.

- Contact Details: It is important to mention the contact details like telephone number, mobile number, and email address so that the applicant can be updated about the loan process and application updates.

- Business Description: Mudra loan application form gives the inquiry information about the business enterprise involved in the loan process. This includes mentioning the line of business activity, business vintage, current annual sales, proposed annual sales, experience in an ongoing business.

- Social Category Details: It is an important feature to mention the social category of the applicant in the PMMY application form. It is necessary to mention the general, SC, ST, OBC, or minority categories in this. The minority class is further divided into alternatives such as Buddhist, Muslim, Sikh, Jain, Parsi, Christian, or others.

- Loan Details: Another important piece of information that needs to be mentioned carefully in the form is the loan details. Applicants are required to specify the loan amount required, and other overdraft or term loan requirements, if applicable.

- Declarations: The form contains a declaration about the loan process which needs to be signed by the applicant along with the form. The signature has to be done with the date and place on which the form is signed.

- Acknowledgment slip: On successful filling of the information on the form, the concerned bank may hand over the acknowledgment slip which should be signed and stamped by the authorized representative of the bank.

Documents Required for Pradhan Mantri Mudra Yojana Form PDF

Apart from filling the application form correctly as per the required information, one is also required to submit certain documents, as listed follows:

- Passport size photographs

- Identity proofs such as Driving license, passport, PAN card, or Voter ID card.

- Address proofs such as voter Id card, passport, aadhar card, or utility bills such as electricity, water, gas, or telephone bill.

- Category or reservation proofs such as ST/ SC/OBC certificates

- Identity and address proofs of the business unit

- Bank account statements for the last six months

- The balance sheet of the last two years and income tax return in case of loan amount above Rs 2 lakhs.

- Partnership deed in case the business unit is a partnership firm

- Memorandum and articles of association for a company

- Certificates of educational qualifications

- Title deed or lease agreement of the business unit

- Small scale industry or MSME registration certificate

- Rent agreement for a rented business premise

Eligibility Criteria for Mudra Yojana (Mudra Loan Eligibility)

- Applicants with a minimum age of 18 years and maximum age of 65 years

- The applicant should have a good transaction history in the bank.

- Individuals, Startups, Small Business Owners, Micro Units, MSMEs

- Traders, Artisans, Manufacturers, Startups, Retailers, etc are also eligible

- Applicants with loan default or irregular repayment history

- An Indian citizen with no criminal background

Types of Prime Minister’s Self Employment Mudra Loan Scheme

Shishu Loan: Under this loan, a loan of up to Rs 50,000 is given to a person. In which interest rate of 10 to 12% is kept.

Kishore Loan: Under Kishore Loan, a loan of more than 50 thousand and up to Rs 5 lakh is available. It has an interest rate ranging from 14 to 17%.

Tarun Loan: In Tarun Loan, a loan of Rs.05 lakh to Rs.10 lakh is given to a person. In which 16% interest rate is kept.

Purpose of Pradhan Mantri Mudra Yojana Loan

MUDRA loan scheme was launched by the Government of India to help MSMEs with the following objectives-

- to start a new business

- To meet working capital requirements

- To manage business cash flow

- for business expansion

- Buying new plant and machinery

- Buying raw materials or increasing inventory

- Hiring or training existing employees

- To buy equipment, commercial vehicles, and more

Here you can free download Pradhan Mantri Mudra Yojana (PMMY) Application Form PDF by clicking on the given link below.